U.S. 2017 CROP OUTLOOK

The US Department of Agriculture (USDA) released a Crop Production statistical report that included information about hop acreage for our upcoming Crop 2017 Harvest season.

In June, the US Department of Agriculture (USDA) released a Crop Production statistical report that included information about hop acreage for our upcoming Crop 2017 Harvest season. You can read the full report here (hops start on page 6). The report covers only the three states with the most hop production: Washington, Oregon, and Idaho.

Pete Mahony, our VP of Supply Chain & Purchasing, highlights what he thinks are some of the most interesting statistics below:

Pacific Northwest (PNW) Acreage

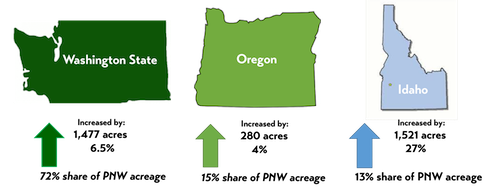

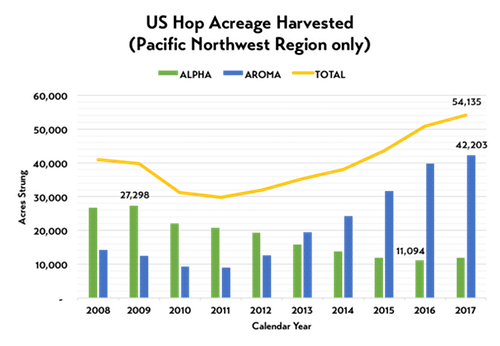

In 2017, total PNW hop acreage increased 6.5% (3,278 acres) over 2016 acreage, to 54,135 acres. This increase is actually slower than the annual increases of 8-17% that we have been experiencing over the past 5 years.

Increase by state is shown below. Notably, Idaho had the largest relative increase at 27%, to bring their share of PNW acreage up to 13%.

Alpha vs. Aroma/Flavor

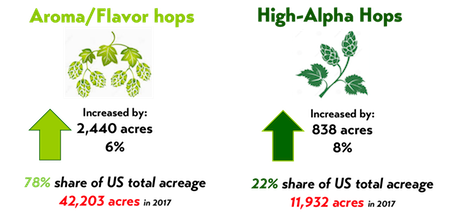

One noteworthy change is that high-alpha acreage increased by 8% in 2017, ending seven consecutive years of acreage decline for this category. Aroma/flavor hops also increased and continue to account for 78% of PNW acreage. Additional details are below:

Varieties

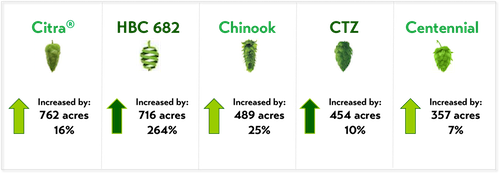

As noted above, large increases aren’t just for aroma/flavor hops anymore! Hop brands and varieties with the largest acreage increases (shown below) include some high-alpha hops as well. In particular, HBC 682 is our new proprietary high-alpha variety from the Hop Breeding Company (soon to be commercially named).

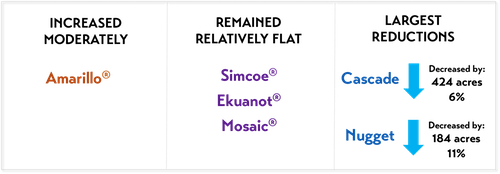

2017 acreage for other notable brands/varieties are shown below:

Distribution

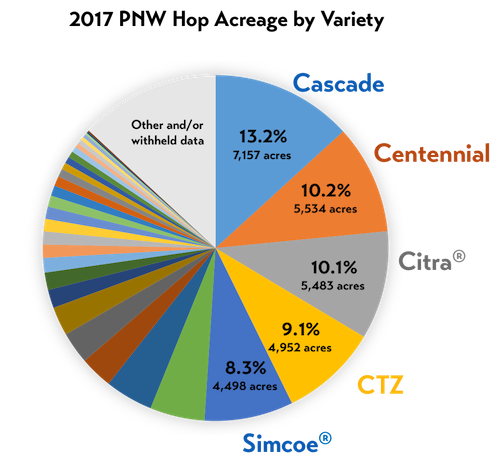

Cascade remains the leading variety in the PNW for the fourth consecutive year, despite its 6% reduction in acreage. Centennial remains the second largest, although it is nearly equal in acreage to Citra®, which overtakes CTZ as the third-largest PNW acreage.

Acreage Trends

Pete says, “The slowing rate of acreage increase in the US is not a surprise, but rather an expected adjustment to changing market conditions, particularly from the US craft segment. The increased high-alpha acreage is a result of the current tightness in global alpha supply. How long this lasts will depend on 2017 crop yields worldwide as well as further high-alpha expansion in both the US and Germany.”

Pete also notes that at this early stage of Crop 2017, all signs point to a good crop, with normal temperatures and slightly above-normal levels of rainfall. Assuming normal yields, the combination of maturing plants and the 6.5% acreage expansion could mean a production increase of 8-10% over last year, which could put the Pacific Northwest hop crop near 95 million lbs. in 2017, compared to last year’s crop of 87.1 million lbs.